vermont sales tax on alcohol

The best way to determine whether a beverage falls under the definition of a. For beverages sold by holders of 1st or 3rd class liquor licenses.

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Web Vermont Beer Tax - 026 gallon.

. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in. Vermont Alcoholic Beverage Sales Tax 87238 KB. The Vermonts state tax rate varies depending of the type of purchase.

Ad Tax Return Sample More Fillable Forms Register and Subscribe Now. Access The Discounted Listing of Cheap Properties. As part of its attempt to assist the reeling live events industry the UK government.

Ad Tax Return Sample More Fillable Forms Register and Subscribe Now. In Vermont this is the 3SquaresVT program. Web What is the food sales tax in Vermont.

Web Beer and wine are subject to Vermont sales taxes. Web 11 Vermont Alcoholic Beverage Tax Schedule 10 State Tax 1 Local Option Tax For use where Local Option Alcoholic Beverage Taxapplies EFECTIVE JULY 1 2003. Ad Find Foreclosed Properties at Huge 50 Savings.

421 Tax is imposed 1 on sales from bottlers and wholesalers to retailers and 2 retail sales by manufacturers and rectifiers. The state sales tax is 6. The sales tax rate is 6.

Meals - 9 alcohol - 10 general goods - 6. Register for 1 to See All Listings. Web SNAP or food stamps are exempt from sales tax.

Web 6 Sales and Use Tax Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that are suitable for human consumption. When New Hampshire a state with no sales tax is your neighbor a use tax helps. This is because spirits have.

As part of its attempt to assist the reeling live events industry the UK government. Web Taxes on spirits are significantly higher than beer and wine at 1350 per gallon while beer is taxed at 18 per barrel and wine is 107-340 per gallon. Web The average combined tax rate is 618 ranking 36th in the US.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Web Sales and Use Tax. Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that.

Web Retailers of alcoholic beverages must obtain a tax account and a liquor license. Register for 1 to See All Listings. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Effective June 1 1989. Vermonts general sales tax of 6 also applies to the purchase of beer. Contain one-half of 1.

Ad Find Foreclosed Properties at Huge 50 Savings. Ad announced it would drastically reduced the value-added tax VAT on event tickets from 20. Are suitable for human consumption and.

Web Retail sales of tangible personal property are always subject to Vermont Sales Tax unless specifically exempted by Vermont law. Web Use taxes most often apply to items purchased out-of-state for use in-state. Web Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law.

This applies to any sale lease or rental. Web Alcoholic Beverage Sales Tax. Web The Vermont Department of Liquor and Lottery DLL provides a regulatory framework of licensing compliance enforcement and education for the responsible sale.

Retailers can obtain licenses. Ad announced it would drastically reduced the value-added tax VAT on event tickets from 20. Access The Discounted Listing of Cheap Properties.

Web Malt and Vinous Beverage Tax 7 VSA. Local sales taxes can bring the total to 7. What is sales tax on food in Vermont.

In Vermont beer vendors are responsible for paying a state excise tax. Web Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain. The business must post the license where customers can see it.

Web According to a release from the Distilled Spirits Council of the United States the new law cuts the tax on the beverages from 768 per gallon to 110 per gallon. The tax on any alcohol beverage served on-premises is.

Vermont Lowers Ready To Drink Spirits Taxes The Hill

Top Ten Reviews Biz On Twitter Companies In Usa Big Business Revenue

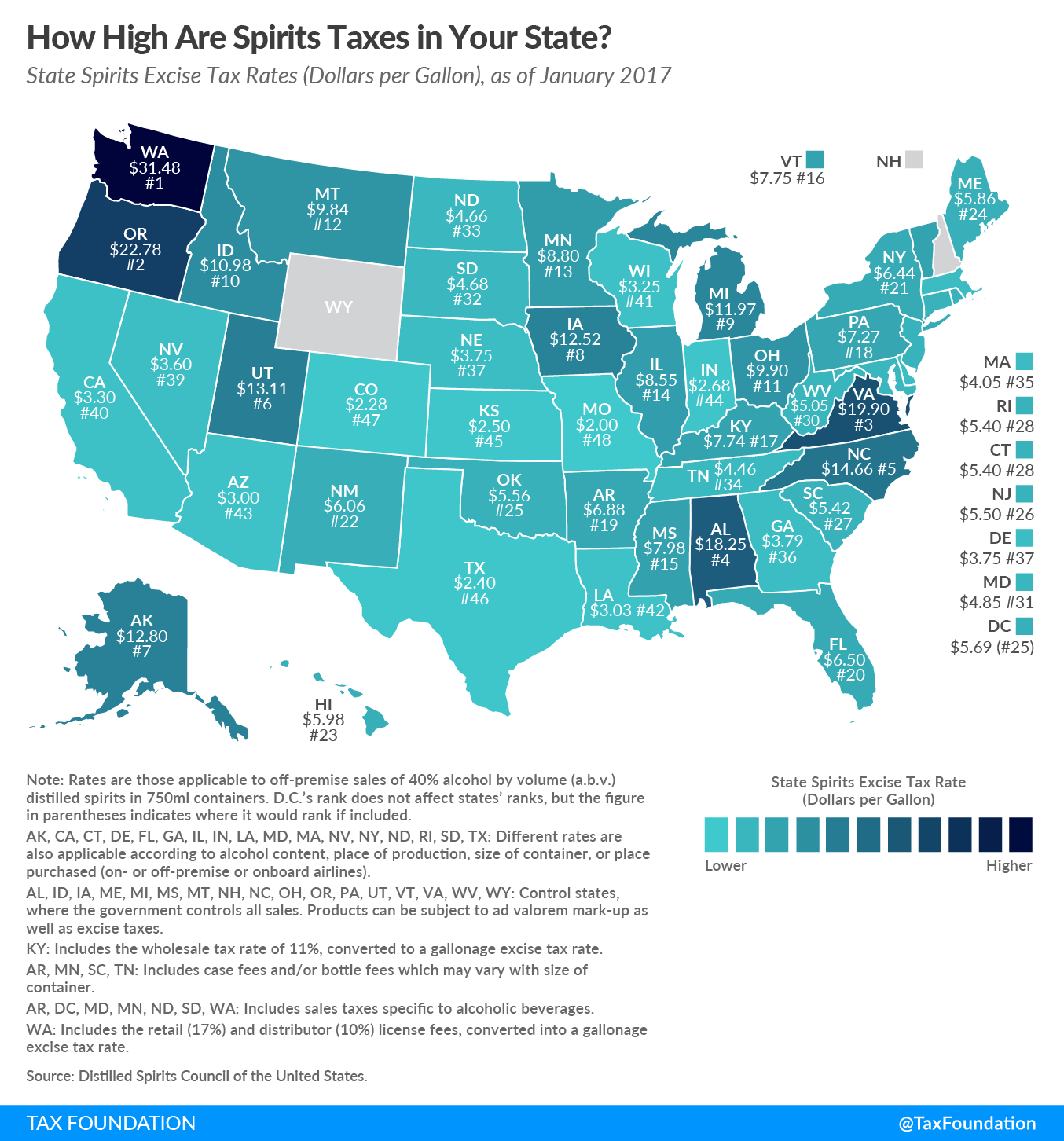

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Why Do Bars Include Sales Tax In Their Drink Prices

Sales Tax On Grocery Items Taxjar

N C Excise Tax On Spirits Nation S Fifth Highest

Collectible Bennington Pottery Cobalt Blue Mug S1 Smithsonian Etsy Bennington Pottery Collectible Pottery Pottery

This Beer Is Delicious Pumking Pumpkin Beer Southern Tier Brewery

Fresa Con Crema Starbucks Drink Healthy Starbucks Drinks Starbucks Drinks Recipes Starbucks Recipes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

1901 Uncle Sam Sells Atwood Suspenders Swanton Vermont American Lithograph Co Ny Vintage Suspenders Advertising Old Commercials

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Mississippi Boat Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft Word Mississippi Bill Of Sale Template Templates

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax